Checking Out the Retirement Landscape in Singapore: Insights Into Schemes, Savings, and Community Resources

The retired life landscape in Singapore provides a complex structure that incorporates different plans and savings options developed to safeguard the financial wellness of its maturing population. Central to this framework is the Central Provident Fund (CPF), which mandates contributions while using varied financial investment paths. In addition, area sources play a crucial duty in advertising active aging and social connection. As we check out these components additionally, it ends up being important to consider just how efficiently they resolve the progressing requirements of retirees in a swiftly altering culture. What ramifications does this have for future retirement preparation?

Review of Retirement Schemes

In Singapore, the landscape of retired life plans is designed to supply economic safety and security and security for residents as they transition into their later years. The key framework regulating retired life financial savings is the Central Provident Fund (CPF), a mandatory social safety system that guarantees people build up funds for their retirement requirements. Via normal contributions from both employers and employees, the CPF system facilitates a robust cost savings system, enabling citizens to money their medical care, retirement, and real estate costs.

In enhancement to the CPF, Singapore offers different volunteer retired life cost savings plans, such as the Supplementary Retired Life Plan (SRS) The SRS offers as a complementary cost savings avenue, permitting people to make additional payments while enjoying tax obligation advantages. In addition, the government proactively promotes financial proficiency and preparation with sources and campaigns intended at encouraging people to make enlightened choices regarding their retirement.

With the maturing population, Singapore has also presented actions to motivate active aging and workforce involvement among elders. These efforts encompass a range of area programs, support solutions, and job opportunity made to boost the general lifestyle for retirees, ensuring they stay engaged and financially safe and secure in their golden years.

Understanding CPF Contributions

The Central Provident Fund (CPF) payments form the foundation of retirement financial savings for Singaporeans, playing a critical role in the buildup of funds required for a stable retired life. Established in 1955, the CPF system makes certain that both companies and employees add a percentage of the worker's regular monthly incomes to different accounts, consisting of the Ordinary Account, Special Account, and Medisave Account, each serving distinct objectives.

Contribution prices vary based upon the staff member's age and wages, with greater rates for more youthful employees to promote higher savings during their working years. Since 2023, the present contribution rate for staff members under 55 is 37%, which is distributed among the various accounts. These contributions are mandatory, making sure that all Singaporeans, no matter of their earnings degrees, can gather cost savings for medical care, retired life, and housing requirements.

In Addition, the CPF scheme is created to provide versatility, permitting members to take out savings at specific landmarks, such as turning 55 or acquiring a home. This structured method to retired life financial savings underscores the value of CPF payments in safeguarding financial stability for individuals in their later years, therefore cultivating a feeling of social protection within the community.

Financial Investment Alternatives for Retirement

When preparing for retirement in Singapore, checking out a selection of investment alternatives is important for maximizing returns and ensuring economic safety and security (how much is enough for retirement in singapore). A well-diversified portfolio not only alleviates danger however additionally boosts possible growth

One common alternative is the Central Provident Fund (CPF) Financial Investment System, which permits members to invest a part of their CPF financial savings in numerous tools such as supplies, bonds, and system counts on. This can produce greater returns compared to typical CPF passion rates.

Additionally, realty financial investment is one more popular method. Numerous senior citizens choose residential property investment, leveraging rental revenue for a consistent capital. Spending in Realty Investment Company (REITs) provides a much more liquid choice while still profiting of the building market.

Shared funds and exchange-traded funds (ETFs) are additionally feasible selections, using diversity and expert monitoring. (how much is enough for retirement in singapore)

Finally, fixed down payments and federal government bonds offer more secure, albeit lower-yielding, options for risk-averse capitalists. By very carefully assessing private danger resistance and financial objectives, retirees can properly utilize web link these investment options to safeguard a comfortable retirement in Singapore.

Neighborhood Assistance Initiatives

One significant campaign is the Energetic Aging Program, which promotes fitness, mental excitement, and social interaction through workshops and area events. These tasks motivate senior citizens to stay energetic and connected with their peers. In addition, volunteer chances allow retirees to add to society, promoting a sense of function and belonging.

The Silver Generation Workplace works as a vital source, providing info on services offered to elders, including health care support, financial assistance, and social services. This campaign aims to equip retirees to navigate their alternatives efficiently.

Moreover, recreation center play a vital role in providing numerous activities customized for elders, fostering a lively area spirit. These centers give not just check my site entertainment tasks but likewise academic workshops that help retirees get brand-new skills and expertise.

Via these area support initiatives, Singapore makes every effort to create an inclusive setting where retirees can flourish, ensuring they lead satisfying lives throughout their retired life years.

Enhancing Lifestyle

How can the high quality of life for retired people in Singapore be properly enhanced? A multifaceted method that integrates wellness, social, and economic health is essential. Firstly, promoting physical health through obtainable medical care solutions and health cares can substantially boost retired people' high quality of life. Campaigns such as normal wellness testings and physical fitness classes tailored for senior citizens motivate active way of livings and minimize age-related health and wellness problems.

Second of all, social interaction remains essential. Recreation center and grassroots organizations can help with social communications with interest-based clubs, workshops, and volunteer possibilities. These platforms not just foster friendships but additionally fight solitude, a typical challenge amongst retired people.

Economic safety is another cornerstone (how much is enough for retirement in singapore). Enhancements to retired read more life cost savings schemes, such as the Central Provident Fund (CPF), can supply retirees with ample sources to sustain their preferred lifestyles. Furthermore, economic literacy programs can encourage retirees to make enlightened decisions pertaining to investments and investing

Final Thought

In conclusion, Singapore's retirement landscape is characterized by a robust structure that incorporates necessary cost savings via the Central Provident Fund with volunteer campaigns like the Supplementary Retired Life Scheme. The diverse investment choices offered equip people to boost their economic protection. In addition, neighborhood support initiatives play a crucial duty in promoting energetic aging and social involvement. With each other, these components add to a safe and secure, fulfilling, and healthy post-retirement life for Singapore's aging population.

The retired life landscape in Singapore provides a multifaceted structure that includes various schemes and savings alternatives created to secure the financial well-being of its maturing populace. The primary structure regulating retirement savings is the Central Provident Fund (CPF), an obligatory social protection scheme that makes certain individuals accumulate funds for their retired life needs.In enhancement to the CPF, Singapore provides numerous voluntary retired life savings systems, such as the Supplementary Retirement System (SRS) Enhancements to retirement savings schemes, such as the Central Provident Fund (CPF), can supply retirees with adequate resources to sustain their desired way of livings.In final thought, Singapore's retired life landscape is characterized by a durable structure that integrates mandatory financial savings through the Central Provident Fund with volunteer campaigns like the Supplementary Retirement Plan.

Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Melissa Joan Hart Then & Now!

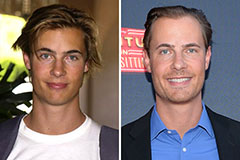

Melissa Joan Hart Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!